Actual performance may differ significantly from backtested performance. Further, backtesting allows the security selection methodology to be adjusted until past returns are maximized. Since trades have not actually been executed, results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity, and may not reflect the impact that certain economic or market factors may have had on the decision-making process. Specifically, backtested results do not reflect actual trading or the effect of material economic and market factors on the decision-making process. Backtested performance is developed with the benefit of hindsight and has inherent limitations. This information is provided for illustrative purposes only. No representations and warranties are made as to the reasonableness of the assumptions. Certain assumptions have been made for modeling purposes and are unlikely to be realized. Changes in these assumptions may have a material impact on the backtested returns presented. General assumptions include: XYZ firm would have been able to purchase the securities recommended by the model and the markets were sufficiently liquid to permit all trading. Backtested results are calculated by the retroactive application of a model constructed on the basis of historical data and based on assumptions integral to the model which may or may not be testable and are subject to losses. The results reflect performance of a strategy not historically offered to investors and does not represent returns that any investor actually attained. Backtested performance is not an indicator of future actual results.

The average price forecast is 18,118.9p, which is 26% higher than the current trading level.ĭisclaimer: The TipRanks Smart Score performance is based on backtested results. Morgan analyst Estelle Weingrod also reiterated her Hold rating on the stock and expects a growth of 19% in the share price.įLTR stock has a Strong Buy rating on TipRanks, backed by seven Buy and two Hold recommendations. Both analysts are predicting an upside of more than 25% in the share price. It includes Buy ratings from analysts Louise Wiseur of UBS and Jordan Bender of JMP Securities. listing for its stock by the end of 2023 or early 2024.Īfter the results, the stock received rating confirmation from three analysts. Analysts believe the share price will further increase as the company is strategically positioned for its upcoming growth phase. On the whole, the stock has recovered well in the last 12 months and gained 57%. Is Flutter Entertainment a Good Stock to Buy? The company’s strategy of acquiring locally recognized brands in rapidly expanding markets has proven to be highly advantageous. Additionally, the growth was also influenced by the acquisition of Italian gaming company Sisal in August 2022. It achieved a 74% increase in revenue and a remarkable 103% rise in adjusted EBITDA, amounting to £284 million, driven by a growing customer base.

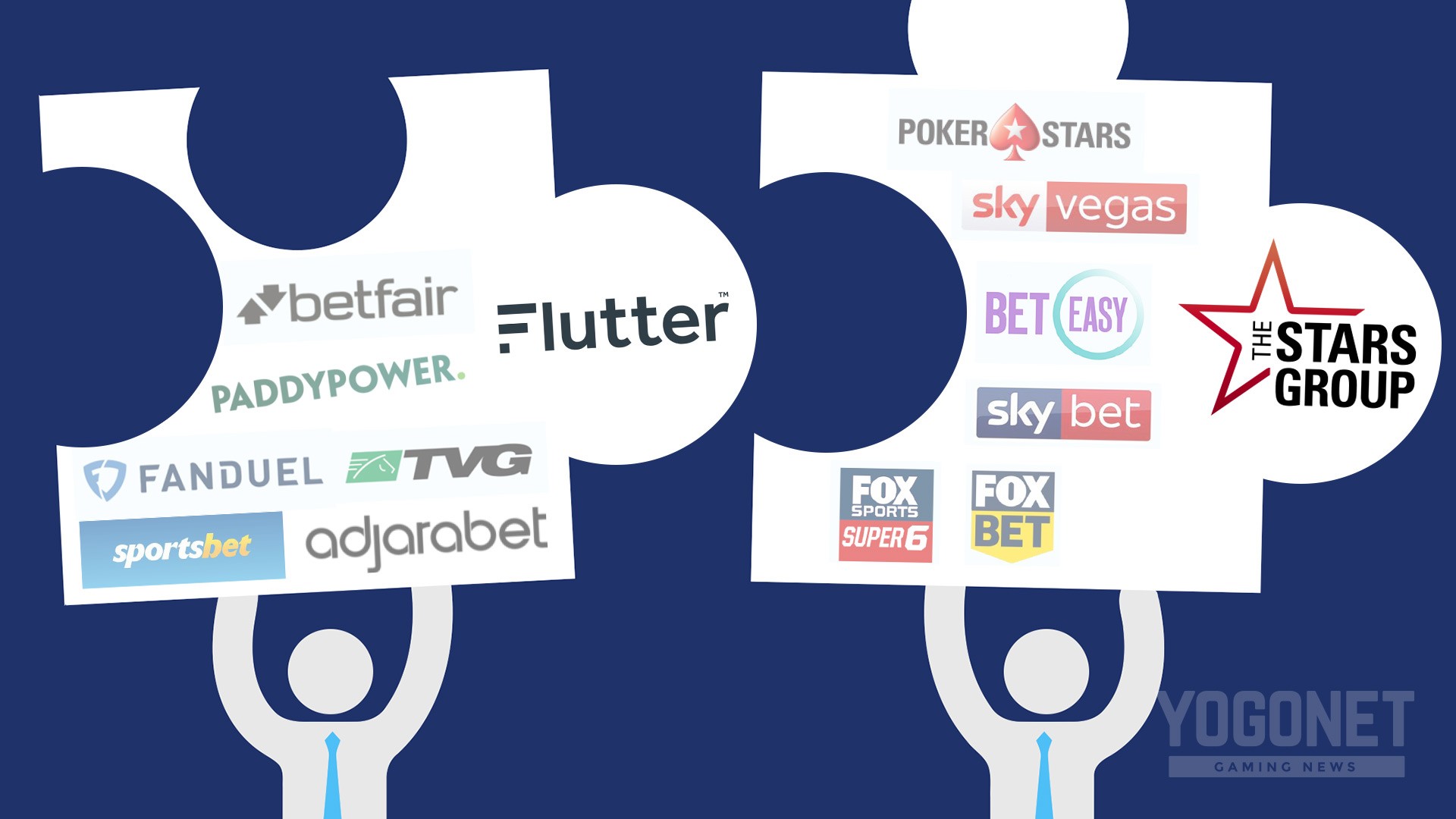

The company’s international division has reached a pivotal point of growth. FanDuel generated £79 million in earnings in the first half, of which £49 million came from the U.S. The company owns a well-known portfolio of brands like Sportsbet, PokerStars, Paddy Power, Betfair, FanDuel, and many more. The numbers were driven by robust player momentum, with average monthly players increasing by 28%, primarily propelled by a notable growth of 43% in the U.S. market witnessed a remarkable 63% increase in revenue to £1.80 billion, while revenue from the U.K. The annual revenue climbed by 42% to £4.81 billion in the first half, up from £3.39 billion a year ago. The group’s EBITDA of £765 million was 76% higher than the £434 million reported last year.

markets.įor the six months ending on June 30, the pre-tax profit amounted to £82.7 million, which is a significant improvement from the loss of £51.4 million recorded during the same period in the previous year. The company’s return to profitability in the second quarter of 2023 was underpinned by its robust performance in the U.S. The stock of the UK-based gambling company Flutter Entertainment PLC ( GB:FLTR) slipped by over 4% yesterday, despite the company posting profits in its first-half earnings for 2023.

0 kommentar(er)

0 kommentar(er)